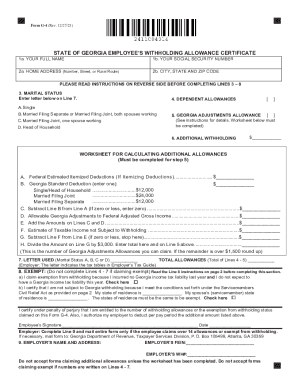

GA DoR G-4 2013 free printable template

Get, Create, Make and Sign

How to edit g4 form online

GA DoR G-4 Form Versions

How to fill out g4 form 2013

How to fill out g4 form:

Who needs g4 form:

Video instructions and help with filling out and completing g4 form

Instructions and Help about printable g4 2020 form

Georgia state tax forms by WWE comet ox articles calm filing income tax reports is certainly not a fun job for anyone, but it is a necessity unless you want to face penalties and legal repercussions if you happen to live in Georgia then you will need Georgia state tax forms in order to complete your state income taxes not all states require residents to prepare state income tax forms, but Georgia is one of the 41 states that do require this the state income tax system in Georgia is considered to be progressive this means that as the amount of taxable income increases the tax rate also increases there are six brackets in the Georgia state income the majority of the taxpayers in the state pay about six percent tax on the income they earn in a year the State Department of Revenue collects Georgia state income tax this serves as the primary source of revenue for the state government the residents of Georgia pay on average about 4.5 million dollars in taxes each year a number of different programs are funded through Georgia state income tax revenue including programs for Health Services highways Corrections public services and education ensuring that you have the correct Georgia state tax forms is essential there are many places where you can locate Georgia state tax forms one of the easiest places to obtain Georgia state tax forms would be online this method allows you to print the Georgia state tax forms that you need quickly and easily also if you make a mistake you can also print more forms and redo them just as quickly, and easily you can also usually obtain Georgia state tax forms from your local library or post office as well most such offices obtain Georgia state tax forms and have them available for pickup for their customers if you choose to prepare your federal as well as your state income taxes using a software program then it is also usually quite easy to obtain the Georgia state tax forms that you need as well the deadline for filing Georgia state tax forms is the same for filing federal income tax forms which is April fifteenth this is also the deadline for paying any taxes that are owed if necessary extensions may be requested through the state's department of revenue but penalties and interest may still apply ah no taxes refunds for Georgia state taxes are usually processed within a few weeks please visit our website at WWW M you

Fill georgia g4 : Try Risk Free

People Also Ask about g4 form

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Fill out your g4 form 2013 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.