GA DoR G-4 2013 free printable template

Show details

PRINT CLEAR Form G-4 (Rev. 1/13) STATE OF GEORGIA EMPLOYEE S WITHHOLDING ALLOWANCE CERTIFICATE 1a. YOUR FULL NAME 1b. YOUR SOCIAL SECURITY NUMBER 2a. HOME ADDRESS (Number, Street, or Rural Route)

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign GA DoR G-4

Edit your GA DoR G-4 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your GA DoR G-4 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit GA DoR G-4 online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit GA DoR G-4. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

Dealing with documents is always simple with pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

GA DoR G-4 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out GA DoR G-4

How to fill out GA DoR G-4

01

Begin by downloading the GA DoR G-4 form from the official website.

02

Fill out the applicant's personal information, including name, address, and contact details.

03

Provide the details of the vehicle, including make, model, year, and Vehicle Identification Number (VIN).

04

Indicate the purpose for which you are submitting the form.

05

Review the form for accuracy and completeness.

06

Sign and date the form at the designated areas.

07

Submit the completed form to the appropriate Georgia Department of Revenue office.

Who needs GA DoR G-4?

01

Individuals applying for vehicle ownership transfers or registration in Georgia.

02

People seeking to obtain title for a newly purchased vehicle.

03

Anyone needing to document the sale or transfer of a vehicle.

Fill

form

: Try Risk Free

People Also Ask about

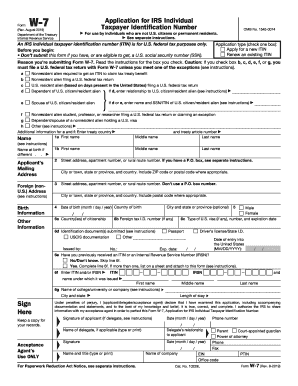

How to fill out an employee withholding allowance certificate?

Here's a step-by-step look at how to complete the form. Step 1: Provide Your Information. Provide your name, address, filing status, and Social Security number. Step 2: Indicate Multiple Jobs or a Working Spouse. Step 3: Add Dependents. Step 4: Add Other Adjustments. Step 5: Sign and Date Form W-4.

Which form is the Employee's withholding allowance Certificate?

Complete Form W-4 so that your employer can withhold the correct federal income tax from your pay.

Who fills out the employee's withholding allowance Certificate?

Form W-4, the Employee's Withholding Certificate, is filled out by an employee to instruct the employer how much to withhold from your paycheck. The IRS requires that individuals pay income taxes gradually throughout the year.

What is the purpose of employee's withholding allowance certificate?

Purpose: This certificate, DE 4, is for California Personal Income Tax (PIT) withholding purposes only. The DE 4 is used to compute the amount of taxes to be withheld from your wages, by your employer, to accurately reflect your state tax withholding obligation.

Is it better to claim 1 or 0?

By placing a “0” on line 5, you are indicating that you want the most amount of tax taken out of your pay each pay period. If you wish to claim 1 for yourself instead, then less tax is taken out of your pay each pay period.

What should I put for my withholding allowance?

Claiming 1 allowance is typically a good idea if you are single and you only have one job. You should claim 1 allowance if you are married and filing jointly. If you are filing as the head of the household, then you would also claim 1 allowance. You will likely be getting a refund back come tax time.

How to properly fill out Employee's withholding allowance Certificate?

Here's a step-by-step look at how to complete the form. Step 1: Provide Your Information. Provide your name, address, filing status, and Social Security number. Step 2: Indicate Multiple Jobs or a Working Spouse. Step 3: Add Dependents. Step 4: Add Other Adjustments. Step 5: Sign and Date Form W-4.

Should my withholding allowance be 0?

Claiming 0 Allowances on your W4 ensures the maximum amount of taxes are withheld from each paycheck. Plus, you'll most likely get a refund back at tax time.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit GA DoR G-4 online?

pdfFiller not only allows you to edit the content of your files but fully rearrange them by changing the number and sequence of pages. Upload your GA DoR G-4 to the editor and make any required adjustments in a couple of clicks. The editor enables you to blackout, type, and erase text in PDFs, add images, sticky notes and text boxes, and much more.

How do I make edits in GA DoR G-4 without leaving Chrome?

Install the pdfFiller Google Chrome Extension in your web browser to begin editing GA DoR G-4 and other documents right from a Google search page. When you examine your documents in Chrome, you may make changes to them. With pdfFiller, you can create fillable documents and update existing PDFs from any internet-connected device.

How can I fill out GA DoR G-4 on an iOS device?

Download and install the pdfFiller iOS app. Then, launch the app and log in or create an account to have access to all of the editing tools of the solution. Upload your GA DoR G-4 from your device or cloud storage to open it, or input the document URL. After filling out all of the essential areas in the document and eSigning it (if necessary), you may save it or share it with others.

What is GA DoR G-4?

GA DoR G-4 is a form used by the Georgia Department of Revenue to report certain types of financial information for tax purposes.

Who is required to file GA DoR G-4?

Individuals and businesses that have specific financial dealings or activities in Georgia that require reporting to the Department of Revenue must file GA DoR G-4.

How to fill out GA DoR G-4?

To fill out GA DoR G-4, taxpayers need to provide their personal information, the nature of the financial activity, and any necessary supporting documentation as outlined in the form's instructions.

What is the purpose of GA DoR G-4?

The purpose of GA DoR G-4 is to ensure compliance with state tax laws by collecting relevant financial information from taxpayers.

What information must be reported on GA DoR G-4?

The information that must be reported on GA DoR G-4 includes taxpayer identification details, specifics of the financial transaction, amounts involved, and any applicable withholding or tax deductions.

Fill out your GA DoR G-4 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

GA DoR G-4 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.